Yesterday’s release of Fed meeting minutes led market participants to believe that the US central bank’s policymaking members are still divided over the timing of the withdrawal of the stimulus-oriented stance that their institution adopted in the wake of the financial crisis.

At the same time, a rather disappointing reading in the ISM Services Index for the month of March, added to the woes of the US dollar and reinforced the feeling that the Fed will not be likely to end its QE2 program prior to its end-June expiry. Combine the above with crude oil hovering at or above 2.5 year highs and gold and silver were given the opportunity to rise to new price peaks as technical and momentum buying intensified throughout the Tuesday session and remained manifest during the overnight hours as well.

At the same time, a rather disappointing reading in the ISM Services Index for the month of March, added to the woes of the US dollar and reinforced the feeling that the Fed will not be likely to end its QE2 program prior to its end-June expiry. Combine the above with crude oil hovering at or above 2.5 year highs and gold and silver were given the opportunity to rise to new price peaks as technical and momentum buying intensified throughout the Tuesday session and remained manifest during the overnight hours as well.

The New York midweek session started off with small gains across the metals’ complex as $108.46 oil and a 0.24-point drop by the greenback on the trade-weighted index underpinned the markets. Spot gold traded $2.20 higher and was quoted at $1459.00 on the open, while silver gained 33 cents to start at $39.61 per ounce. Having broken above the $1,450 mark, gold appears to be aiming towards first resistance around the $1,475.00 area while silver might do battle with the round figure target just above current levels.

Signs that such elevated gold prices are starting to once again bite into India’s gold demand have been growing in recent days, despite the on-going countdown of the country’s first auspicious season of the year for weddings: March — May. Urban would-be buyers are apparently exhibiting more price sensitivity to the yellow metal and are somewhat confirming Morgan Stanley’ recent estimations that bullion demand in urban India might suffer a 16% decline this year.

Middle and high-income Indian households could also be reflecting shifting preferences in luxury spending patterns as gold currently has to compete with intensely advertised and very visible competing goods. Hopefully, the fact that more than two-thirds of India remains rurally domiciled will o a long way towards mitigating this type of "demand destruction." There is however little doubt that the current reluctance to open wallets is largely an issue of record price tags.

A note of clarification: do not confuse Indian gold demand tonnage with Indian gold import tonnage, as has been the case on occasion when reference were made to surging local interest in bullion. Overall demand can be partially satisfied by the recycling and resale of second-hand gold. Of that, there is plenty around; as recently alluded to in the World Gold Council’s estimate of some 18,000 tonnes of the yellow metal that are thought to be residing in the households of India.

Spot platinum added $12 at the open this morning rising to the $1,805.00 mark while palladium climbed $2 and was quoted at the $790.00 per ounce bid price per ounce. The euro reached a 15-month high against the US dollar this morning, bolstered by perceptions that tomorrow’s meeting of the ECB will yield the first rate hike by that institution in a couple of years.

The common currency reached $1.4319 after markets learned of a larger-than-anticipated gain in German factory orders for February. Between the ECB-oriented anticipations and the German data, the still-present woes of Portugal were all but ignored by currency speculators, despite the big spike in the yields (up to near 6%) that the country had to pay at its latest T-bill auction to lure buyers. On the other hand, the Japanese yen lost more of its post-quake speculatively induced "steam" and fell to a six month low against the US currency this morning.

As previously noted, the types of bets currently manifest in the commodities space would indicate that the bettors are expecting massive price gains trends to become a reality. Such developments, it is conceivable, will be a matter of regional circumstances.

While, for example, Global Markets Institute’s Abby Joseph Cohen opines that, at least as far as the US is concerned, it is "hard to see where significant inflation might come from," given current US core inflation, US wage pressure, and US factory capacity utilization levels, the Asian Development Bank warned yesterday that several regional central banks are now "behind the curve" and need to tackle inflation through what it calls "preemptive action" sooner rather than later. Regional GDP is expected to race ahead at 7.8% in the current year following a 9% leap in 2010.

As far as investor bullishness on various asset classes is concerned, the overall tilt (when viewed within the context of the aforementioned inflation-oriented anxiety but also based on pure profit motivations) remains obviously positive (perhaps too positive) as regards the broader commodities’ niche.

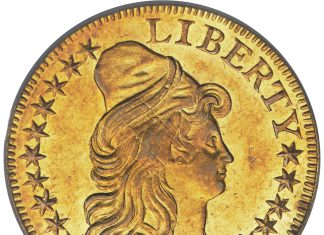

The release of a March 23 institutional investor survey, one that coincided with Barclays Capital’s seventh annual Commodities Investor Conference in London, reveals that appetite for increased direct exposure to commodities is still high (75%) among such players, at least for as long as interest rates remain low (through mid-year?). More than $62 billion in funds was poured into the commodities’ space last year. One glance at the image below might just offer the best explanation for this phenomenon:

The Barclays survey showed that more than 60% of institutional investors are seeking "active management" strategies over the next 12 months. Perhaps "active" in this sense implies being very nimble and keeping one finger on the "sell" button.

That could be because the survey also warns that

"the current year might offer mixed results across commodities, and indicates that investors are concerned with a very different set of risks, particularly around geopolitics, slower growth in China and turmoil in the energy markets. Investors chose crude oil as the commodity that will perform best whilst natural gas was chosen as the worst. The popularity of precious metals appears to be waning. Whilst 2010 was a stellar year for gold, it came nearly bottom of the list in its potential to be a star performer in 2011."

Whatever caution might be applied to the former, it applies doubly to silver. As was previously pointed out in a comparative investment table that appeared in these columns, the white metal presents exciting returns (on occasion) but it does so while carrying the highest degree of investment risk among competing assets (double that in gold, for example).

Barclays Capital (it keeps coming up when it comes to caution) opines that silver has presently become "detached" from its supply and demand fundamentals, owing largely to what it labels as "retail investor interest." Barclays cautions that if such lavish attention from the investment crowd falters, so will prices — only to a much larger extent, whether the metric that will be applied is dollars per ounce or percentage losses.

Until ECB day,

Jon Nadler

Senior Analyst

Kitco Metals Inc.

North America

www.kitco.com and www.kitco.cn

Blog: http://www.kitco.com/ind/index.html#nadler