Metals markets opened with a tad of weakness manifest in gold and lingering strength in the other components of the complex this morning.

Metals markets opened with a tad of weakness manifest in gold and lingering strength in the other components of the complex this morning.

Spot gold traded near the $1,525.00 area showing initial losses of from 20 cents to $1.50 per ounce on the bid-side.

Silver remained higher, adding 55 cents on the open to rise to the $37.18 mark per ounce. Meanwhile, platinum and palladium each gained $7 per ounce to start the midweek session off at $1,770.00 and at $740.00 the ounce respectively. No change was seen in rhodium at $1,880.00 per troy ounce on the bid-side.

BNP Paribas noted in its most recent Metals Market Comment that last year’s stellar performer — palladium- (which quietly doubled in price while everyone was mesmerized by gold’s and silver’s performance) might be in for a bit of a tougher time at this juncture. The bank’s analysts note that:

"investment demand was undoubtedly a strong driver of palladium prices in 2010, with inflows into ETFs totaling 1.1million ounces — equivalent to about 17% of mine supply."

The BNP team opines that the recently witnessed declines in investor interest are potentially one of the main downside risks to palladium’s price trend for the current year. Palladium-based ETFs have now experienced net outflows of 42,000 ounces in the year-to-date, and according to BNP Paribas:

"the tide shows little sign of turning so far, as market sentiment remains depressed by the impact of the Japanese earthquake, softer economic data in the US, and the decline in global liquidity."

Thus, the analytical team at the bank concluded that its "initial expectation for palladium investment demand to reach 670,000 ounces may prove too optimistic," and that "we could instead see net inflows being closer to 150,000 ounces."

As was largely expected, US durable goods orders did experience a sharp drop last month after having shown a spectacular rise in March. The level of new orders for aircraft and autos led the contraction in the US economic metric which fell by 3.6% in April. If one removes the volatile transportation orders component from the equation, the figure for durable goods orders for April shows a drop of 1.5%.

The durable goods statistics did not play very well into the hands of crude oil gamblers this morning; black gold lost more than one dollar and fell to under $98.65 per barrel, ahead of the release of inventory data. Yesterday, of course, it was a bit of a different story in the oil pits. The story was, in part, no different in silver this morning. The white metal gained in value after the durable goods orders figures were released. That’s logical, no? Weakness in the economy equals higher silver (an industrial metal) valuations. The excuse, to be offered later, will be that because of such weak data the Fed will unleash QE2.5 or QE3 and we thus have ample reason to push silver to higher ground. Read on, and you might see why the daily drama in certain commodities has so much behind it than just the flow of economic news.

The pitched battle of the speculators versus the regulators intensified yesterday when CFTC Chairman Gary Gensler was noted to have highlighted the pressing need for tougher rules intended to rein in the levels of speculation in certain commodities "such as oil, gold, and natural gas" — according to Bloomberg News. Ever since 2008, Mr. Gensler’s agency and a host of US lawmakers have been grappling with the effects that aggressive gambling in commodities has had on consumers and the economy at large.

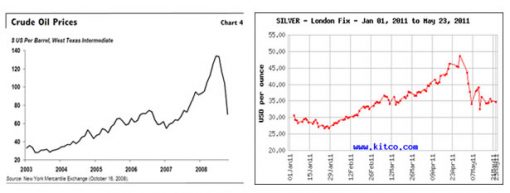

Albeit it has been alleged by market players that no one on the supervisory side has come up with proof that oil, for example, rose to over $147 per barrel on account of the activities of speculative players, there remain plenty of questions surrounding the logic of such a price tag being attached to a drum of black gold on fundamentals alone. In turn, the speculators have failed to describe the precise shift in market fundamentals that might have accounted for oil’s spike to the aforementioned figure, or, for that matter, silver’s orbital arc price trajectory that took it just past $50 per ounce in a matter of but a few weeks.

As it turns out, evidence on hand to the CFTC may have been just be strong enough for it to sue at least two oil traders and their firms for booking some $50 million in profits resulting from manipulating the price of oil to those 2008 price peaks. The suit notes that one of the defendants amassed a sufficient quantity of physical West Texas Intermediate crude…

"to dominate and control WTI supply even though they had no commercial need for crude oil."

Albeit the CFTC was "awarded" more than $200 million in penalties and fines in 2010, it has, thus far, been unable to collect monies from the defendants.

And now, for a quick game of "spot the similarities" — in a pictorial form:

Buried somewhere deep in yesterday’s news was the little-known fact that in 2010, for instance, the firm of Moore Capital Management was fined $25 million for attempting to manipulate settlement prices for platinum and palladium futures. If a wild guess had to be made, it might not be long before we learn of who and what might have conspired to push silver prices to their peak seen prior to May Day. Just a wild guess. Apropos of silver, the last surviving silver broker to the famous Hunt Brothers thinks that the white metal is "showing all of the signs of a broken market" and does not want to touch it until it trades in the $20s.

Some of this "activity" also likely played into the OECD’s global economic forecast issued today in London. The half-century old Paris-based think-tank projects that the world’s economic growth rate will be near the 4.2% level this year; however, it also warns that rising oil and other commodities (along with the European debt situation and a slowing developing in China’s economy) could dampen such progress. It is quite interesting to note that what is considered by the OECD as a "neutral" policy rate stance by central banks is on the order of 4.5%. Thus, even a rise back up to the 1% level could be interpreted as still "stimulative" in nature.

The OECD noted that the fiscal stimuli that were put into place by assorted central banks around the world in the wake of the crisis are now gradually being replaced by a more self-sustaining pattern of trade and investment and it urged the US Fed to commence withdrawing its own stimulus sooner, rather than having to do so later, in a more "aggressive" fashion. In fact, the risks potentially being posed to the US economy by a sudden and sharp exit from accommodation are thought to be sufficiently significant for the OECD to have "nudged" the Fed to "begin a modest reduction in monetary stimulus during the second half of this year."

The institution also advised a one percent total hike in the US’ Fed policy rate for the remainder of 2011. Hardly any such forward-thinking advice remains on display in certain camps however; we still read stories that argue for the "inevitable" QE3 coming to a market theatre near you. Ah, good old Ludwig [von Mises] would be proud of such a thesis; however, it rests mainly on the game of "chicken" that the Fed is putatively not going to be amenable to play during an election year such as 2012 will be.

Until tomorrow,

Jon Nadler

Senior Analyst

Kitco Metals Inc.

North America

www.kitco.com and www.kitco.cn

Blog: http://www.kitco.com/ind/index.html#nadler