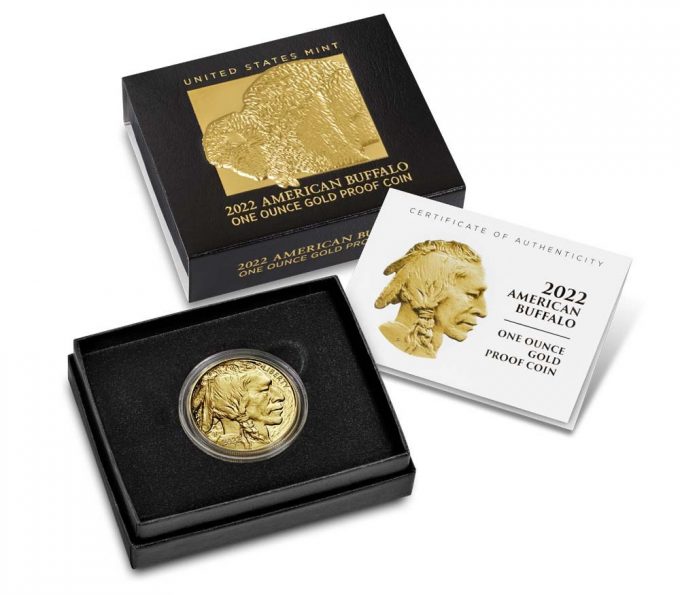

Today at noon ET, the United States Mint will start selling their 2022-W $50 Proof American Buffalo Gold Coin. Each is produced at the West Point Mint for coin collectors and contains an ounce of .9999 fine 24-karat gold.

This collectible is a companion to investor-targeted bullion versions also minted each year. Both series debuted in 2006 as the U.S. Mint’s first ever 24-karat gold coins.

Pricing for the proof coin is $2,790.00. That is subject to change weekly, however, based on the Mint’s pricing matrix that ties coin prices to fluctuations in the gold market. The coin’s current price is based on an average of LBMA gold prices that resides within $1,850.00 to $1,899.99 an ounce.

Coin Designs and Specifications

American Buffalo Gold Coins bear a design based on the 1913 Buffalo nickel, Type 1, as created by sculptor James Earle Fraser.

Obverses (heads side) offer a likeness of an American Indian. The right-facing profile is said to have been created using a combination of real men Fraser encountered.

Inscriptions around the portrait include "LIBERTY" and "2022." The artist’s initial of "F" is also shown.

Reverses (tails side), we find the source of the coin’s naming. An American Buffalo, also known as a bison, is shown standing on a mound of dirt.

Reverse inscriptions include "UNITED STATES OF AMERICA," "E PLURIBUS UNUM," "IN GOD WE TRUST," "$50," "1 OZ.," and ".9999 FINE GOLD."

U.S. Mint provided specifications for the coin are as follows:

Coin Specifications

| Denomination: | $50 |

| Finish: | Proof |

| Composition: | 99.99% Gold |

| Diameter: | 1.287 inches (32.70 mm) |

| Weight: | 1.0000 troy ounce (31.103 grams) |

| Edge: | Reeded |

| Mint and Mint Mark: | West Point – W |

| Privy Mark: | None |

2022-W $50 Proof American Buffalo Gold Coin Sales (2006 to 2021)

Despite their higher price, thousands of these gold coins are sold annually, as illustrated in the table below.

| Year | Opening Price | Final Sales |

|---|---|---|

| 2021 (released on May 14) | $2,740.00 | 16,854 |

| 2020 (released on April 9) | $2,315.00 | 11,887 |

| 2019 (released on April 12) | $1,660.00 | 14,844 |

| 2018 (released on May 10) | $1,710.00 | 15,756 |

| 2017 (released on May 11) | $1,590.00 | 15,810 |

| 2016 (released on March 31) | $1,590.00 | 21,878 |

| 2015 (released on April 9) | $1,590.00 | 16,591 |

| 2014 (released on May 8) | $1,640.00 | 20,557 |

| 2013 (released on May 23) | $1,790.00 | 18,594 |

| 2012 (released March 15) | $1,960.00 | 19,715 |

| 2011 (released May 19) | $1,760.00 | 28,683 |

| 2010 (released June 3) | $1,510.00 | 49,263 |

| 2009 (released October 29) | $1,360.00 | 49,306 |

| 2008 (released July 22) | $1,199.95 | 18,863 |

| 2007 (released May 23) | $825.95 | 58,998 |

| 2006 (released June 22) | $800.00 | 246,267 |

Other variations of the coin have also been issued in past years by the U.S. Mint including fractional sizes and a special reverse proof edition.

Ordering and Mintage

2022-W $50 Proof American Buffalo Gold Coin may be ordered directly from the U.S. Mint via its webpage dedicated to gold coins.

Mintage for the coin is capped at 16,000.