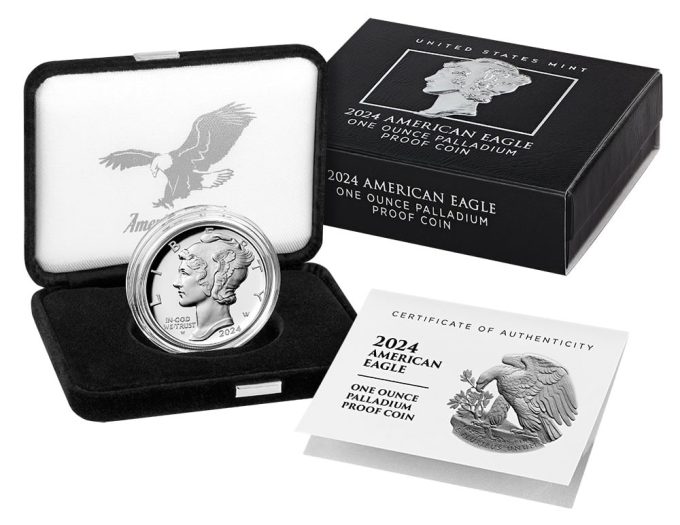

Just a few new products are slated to appear from the United States Mint this month, starting with today’s release of the 2024-W $25 Proof American Palladium Eagle.

This Palladium Eagle is made from one ounce of 99.95% palladium and, like its gold, platinum, and silver American Eagle predecessors, serves as the numismatic version to its bullion counterpart. It features a proof finish noted for sharp reliefs, with mirror-like backgrounds and frosted, sculpted details, creating a striking cameo effect.

The coin’s designs are collector favorites, featuring Adolph A. Weinman’s Winged Liberty on the obverse (heads side) and an eagle design on the reverse (tails side), adapted from his 1907 American Institute of Architects Gold Medal. Both are struck in high relief.

American Palladium Eagle Series

American Palladium Eagles were authorized by Congress under Public Law 111-303. The legislation specifies that each year’s numismatic finish must differ in a significant way from the previous year’s, "to the greatest extent possible." In accordance with this directive, the U.S. Mint has released the following Palladium Eagles, with sales figures as listed:

- 2017 Bullion Palladium Eagle – 15,000

- 2018-W Proof Palladium Eagle – 14,986

- 2019-W Reverse Proof Palladium Eagle – 18,839

- 2020-W Uncirculated Palladium Eagle – 9,746

- 2021 Bullion Palladium Eagle – 8,700

- 2021-W Proof Palladium Eagle – 5,170

- 2022-W Reverse Proof Palladium Eagle – 7,394

- 2023-W Uncirculated Palladium Eagle – 5,764

Pricing for the coins have fluctuated significantly since their introduction. For example, the 2018-W Proof American Palladium Eagle launched at $1,387.50, while the 2022 reverse proof debuted at a striking $3,050.00. In contrast, last year’s uncirculated Palladium Eagle was introduced at $2,150.00.

Palladium Eagle Designs and Specifications

As previously noted, Adolph Weinman’s artistry is featured on both sides of the coin, as required by Public Law 111-303. This includes his "Winged Liberty" design, which first appeared on the 1916 Mercury dime, on the obverse, and an eagle image adapted from the 1907 American Institute of Architects Gold Medal on the reverse.

On the obverse, Winged Liberty is surrounded by the inscriptions "LIBERTY," "IN GOD WE TRUST," "2024," and Weinman’s distinct initials. A "W" mintmark indicates the coin was produced at the West Point Mint.

The eagle on the reverse is accompanied by the inscriptions "UNITED STATES of AMERICA," "$25," "1 OZ. Pd (the chemical symbol for Palladium) .9995 FINE," and "E PLURIBUS UNUM."

American Palladium Eagle Specifications

| Denomination: | $25 |

|---|---|

| Finish: | Reverse Proof |

| Composition: | 99.95% palladium |

| Palladium Fine Weight: | 1.000 troy oz. |

| Diameter: | 1.340 inches (34.03 mm) |

| Edge: | Reeded |

| Mint and Mint Mark: | West Point – W |

| Privy Mark: | None |

Price and Ordering

The 2024-W Proof American Palladium Eagle is available for ordering directly from the U.S. Mint through its palladium product page.

The coin is priced at $1,900, with an initial household order limit of 10 and a maximum mintage of 7,500. Its price may adjust weekly according to the Mint’s precious metal pricing matrix, with the current price based on an average palladium value per ounce falling within the $950.00 to $999.99 range.