Stack’s Bowers Galleries is honored to announce that they have once again been awarded a contract from the United States Mint to auction an exciting selection of modern rarities.

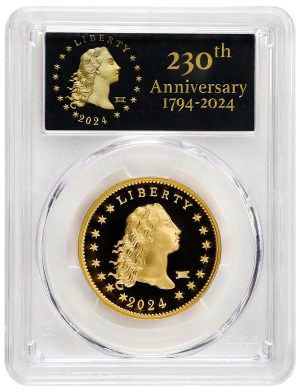

Presented in a stand-alone auction on Thursday, December 12, 2024, will be a special offering of 2024 Flowing Hair High Relief Gold coins struck to commemorate the 230th anniversary of America’s first silver dollar — the 1794 Flowing Hair dollar. These exciting gold coins serve as a faithful homage to the original dollar, featuring obverse and reverse designs re-sculpted by Mint medallic artists.

Included in the Stack’s Bowers Galleries auction will be the first 230 gold coins struck in this series, each featuring a "230" privy mark to designate their historic significance. Struck in 1 ounce of .9999 fine gold at the United States Mint facility in West Point, these special privy-mark gold coins will be available exclusively through the Stack’s Bowers Galleries sale. Each has been graded by Professional Coin Grading Services (PCGS). They will also feature a special Certificate of Authenticity hand signed by United States Mint Director Ventris C. Gibson. The very first of these privy marked coins will be accompanied by the canceled obverse and reverse dies used to strike the series, presented in a custom-built box that houses the coin and the dies.

The original 1794 Flowing Hair silver dollar symbolized the birth of a new chapter in American history and the global economy. Designed by Mint Chief Engraver Robert Scot under the guidance of Mint Director David Rittenhouse, just 1,758 dollars were delivered on October 15, 1794, and fewer than 150 coins are estimated to survive for today’s collectors. Stack’s Bowers Galleries has handled every significant example of this issue across their 90-year history, setting a world record for the first 1794 dollar struck at over $10 million and selling numerous others for strong seven-figure sums. They are excited to bring this same record-setting expertise to the auction sale of the privy mark Flowing Hair gold coins this December.

In recognition of this historic offering, Stack’s Bowers Galleries will also waive the Buyer’s Premium on these 230th Anniversary gold coins, meaning that the highest bid on each lot (the hammer price) will be the final amount paid by the winning bidder (excluding shipping fees). Further, in accordance with the Supremacy Clause of the United States Constitution, the Mint is not obligated to charge or collect any state sales tax on the sale of these Flowing Hair gold coins, which should encourage even stronger bidding from collectors!

This partnership represents only the third time the United States Mint has engaged with a third-party auctioneer to present a special coin to collectors, and Stack’s Bowers Galleries is honored to have been selected for each of these three occasions. Stack’s (in partnership with Sotheby’s) was selected for the July 2002 sale of the only 1933 Saint-Gaudens double eagle authorized for private ownership, which went on to realize a then-world record of over $7.5 million. More recently, the Mint awarded Stack’s Bowers Galleries the contract to auction the special 35th Anniversary American Eagle at Dusk and at Dawn coins which realized over $4.6 million in their September 2022 sale.

Stack’s Bowers Galleries is proud to have been selected by the United States Mint to auction the privy mark 2024 Flowing Hair gold coins and is excited to present them to the collecting community in their exclusive December sale. For more information about these historic 230th Anniversary gold coins or to register for bidding in the auction, please contact Stack’s Bowers Galleries today at Info@StacksBowers.com or 800-566-2580.